The world is evolving faster than ever, and kids are adapting quickly, so now is the perfect time to teach the basics about managing finances.

It happens to every parent at some point-we turn into our own parents and utter the phrase “Kids these days…” While that’s true for every generation, today’s kids of all ages are more advanced at mastering the latest technology and adapting to doing everything online. Sure, they can probably connect all entertainment devices in your home to a single controller, but do they even know the basics of managing finances? Probably not.

Learn some interesting facts about starting good savings habits early, learning resources for all ages, and how Union Bank’s Kid$ Ka$h Savings account is the perfect product for your little savers.

Starting Good Savings Habits Early Pays Off

We all know any good habit can be slow to make it a normal part of your life, but by starting early kids can learn quickly and, in some cases, even do better than their parents when it comes to savings.

Here are some interesting facts:

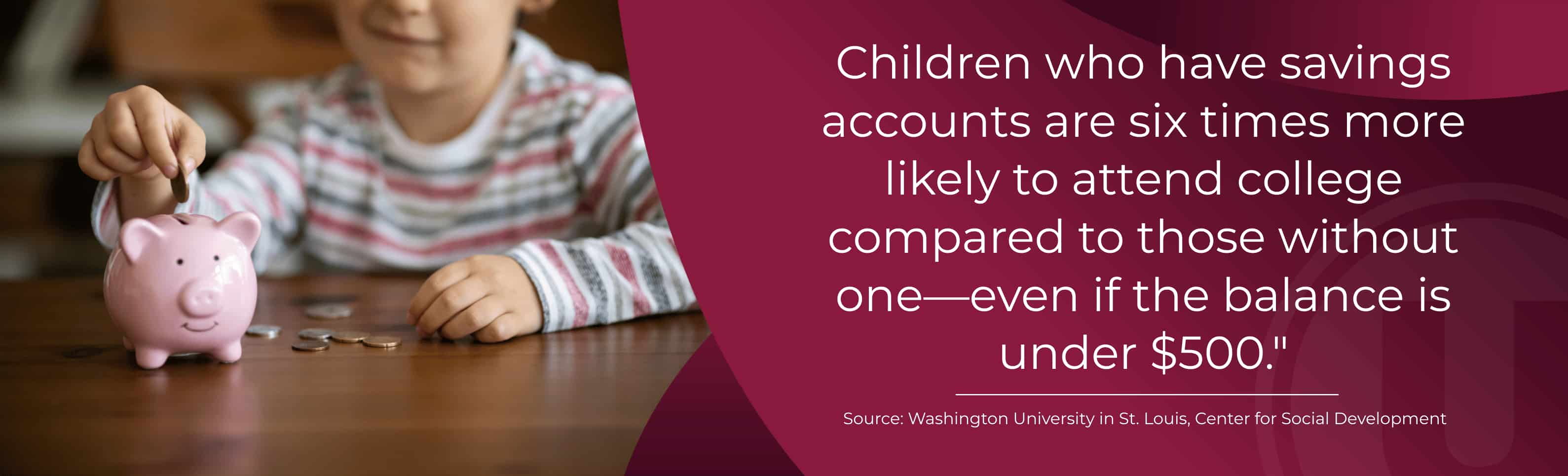

- Roughly 39% of kids under 18 have their own savings account that they contribute their own funds to

- Over 120 financial institutions offer Children’s Savings Accounts (CSA) that reach more than 956,000 children nationwide

Having Conversations at All Stages of Growing Up

Children are naturally curious and experiential learners, often taking on characteristics and habits from parents, siblings, and friends. While some parents think that having a conversation about finances with a child in pre-school is too early, research shows that starting early has advantages (as we saw earlier). But how should you go about talking to kids about finances?

“Research shows that teaching your kids about money provides all sorts of benefits, including better financial decision-making skills in adulthood and lifelong savings habits,” says Cameron Huddlston, financial expert and author. “However, it also can open the door to questions from your kids about your family’s finances: How much money do you make? Are we rich? Are we poor? Mom and Dad, are you saving for retirement, or am I going to have to support you?” (OK, so your 8-year-old probably won’t ask that, but your 28-year-old might.)

Just like their education path, having age appropriate conversations can set the stage for good financial habits as they enter young adulthood.

Preschool & Elementary

- Start by showing kids coins and bills so they know what money looks and feels like

- Share how you have a job to get money to pay for things, and fold in how you have to save your money

- Consider introducing the concept of wants and needs

Elementary & Middle School

- Have them help with grocery shopping by creating a shopping list, how to calculate costs, and even how to compare prices on similar products

- Talk to them about what they want to spend their allowance on and help create a budget and turn it into a challenge to save enough money during a certain time

- Introduce debit and credit cards, how they work, and open a child savings account like Union Bank’s Kid$ Ka$h

Open a Union Bank Kid$ Ka$h Savings Account

We’ve covered a lot of topics and information about talking to kids about finances, now take the first step in their journey. Visit any of our branches to open a Union Bank Kid$ Kas% Saving Accounts and start applying what you’ve learned from this blog.

Union Bank Kid$ Ka$h Saving Accounts is for children 13 and under and comes with great benefits and resources:

- Open an account with as little as $10

- Earn interest on all balances and is paid out quarterly (talk about introduction to investment and return)

- Exclusive activities and benefits held throughout the year to teach better finances habits in fun and engaging ways

However you choose to open an account, make sure to include them as part of the learning experience.

Make it a Family Affair

Get the whole family involved in better financial habits by switching to Union Bank! Choose from a wide range of products and services, and make it a regular thing for everyone to review their statements and savings at the same time.

- Personal Checking – choose from Basic checking to Platinum Advantage and get great benefits

- Savings & Investments – from Money Markets, Christmas Club, and Retirement accounts we have the right tools for your financial future

- Personal Loans – consolidated debt, make home improvements, or take the whole family on a dream vacation

- U for You Blog – get sound advice on a wide range of topics that help you maximize your hard-earned money.

Open a new account online or visit us at one of our locations to have a Union Bank representative help you switch your old accounts. We’re here to help you anytime!